About Anthem Blue Cross

- What Does Anthem Blue Cross Ppo Cover

- What Is The Copay For Anthem Blue Cross

- Anthem Blue Cross Ppo Contact

- Blue Cross Blue Shield Ppo Copay

- Anthem Blue Cross Ppo Specialist Copay

- Anthem Blue Cross Ppo Contact Number

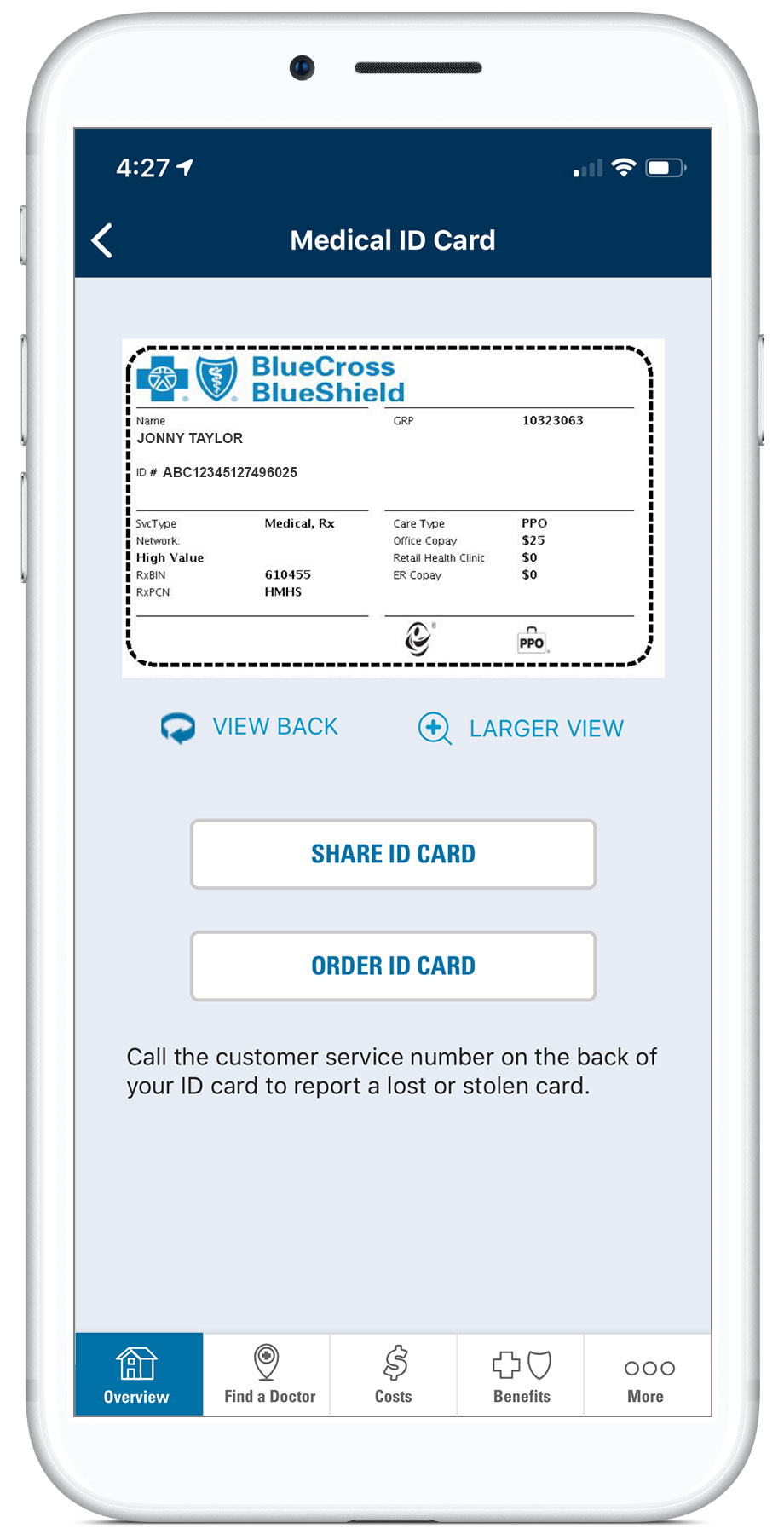

You may also have a copay after you pay your deductible, and when you owe coinsurance. Your Blue Cross ID card may list copays for some visits. You can also log in to your account, or register for one, on our website or using the mobile app to see your plan’s copays.

- Anthem MediBlue Access Core (PPO) H4036-016 is a 2021 Medicare Advantage Plan or Medicare Part-C plan by Anthem Blue Cross and Blue Shield available to residents in Wisconsin. This plan does not provide additional Medicare prescription drug (Part-D) coverage. The Anthem MediBlue Access Core (PPO) has a monthly premium of $0 and has an in-network Maximum Out-of-Pocket limit of $5,500.

- Anthem Blue Cross. Your Plan: PPO Plan. Your Network: National PPO (BlueCard PPO) This summary of benefits is a brief outline of coverage, designed to help you with the selection process. This summary does not reflect each and every benefit, exclusion and limitation which may apply to the coverage.

- Anthem® Blue Cross and Blue Shield Your Plan: Benesch, Friedlander, Coplan & Aronoff LLP-Anthem Blue Access PPO with Essential Rx Formulary on the National w/R90 Network with Optional Home Delivery Your Network: Blue Access-Effective Covered Medical Benefits Cost if you use an In-Network Provider Cost if you use a Non-Network Provider.

Anthem Blue Cross offers the health insurance coverage and choices you – and your employees – want and need. You can select from a variety of plan types, including HMO, PPO, EPO, and Health Savings Account-compatible plans. Anthem has the largest provider network in the nation (and in California), so you’re likely to find that your preferred doctor is already in-network – saving you money and time.

Don’t forget about Anthem’s smart tools designed to help employees make the most of their group health benefits. It’s easy to find a doctor, access your virtual ID card, or get plan information, claims data, and other info with the Anthem Anywhere mobile app. Click below to explore the details on any of the Anthem plans available through CaliforniaChoice.

Quick Plan Highlights

Below are some of our most popular Anthem Blue Cross health plans along with a snapshot of plan coverage and out-of-pocket costs. For a complete list of coverage options, click Download All Plans below to see the most current plan information.

Network Prudent Buyer - Small Group Calendar Year Deductible $1,350 / $2,700 Out of Network$500 / $1,500 Out of Network$5,600 / $11,200 (combined Med/Rx/Pediatric dental ded)(applies to Max OOPM) Out-of-Pocket Max Ind/Fam: $8,000 / $16,000 Dr. Office Visit (PCP): $65 Copay (first 3 visits) - $65 Copay Urgent Care: 60% Emergency Room $300 Copay - 60% Network Advantage PPO Out of Network Calendar Year Deductible $2,700 / $5,400 Out-of-Pocket Max Ind/Fam: $7,900 / $15,800 $15,800 / $31,600 Dr. Office Visit (PCP): $40 Copay (ded waived) 50% Urgent Care: $80 Copay (ded waived) 50% Emergency Room $350 Copay - 60% Network Advantage PPO Out of Network Calendar Year Deductible $2,000 / $4,000 Out-of-Pocket Max Ind/Fam: $6,000 / $12,000 $12,000 / $24,000 Dr. Office Visit (PCP): $30 Copay (ded waived) 50% Urgent Care: $60 Copay (ded waived) 50% Emergency Room $250 Copay - 80% Network Select HMO Calendar Year Deductible None Out-of-Pocket Max Ind/Fam: $2,200 / $4,400 Dr. Office Visit (PCP): $15 Copay Urgent Care: $15 Copay Emergency Room $200 Copay * All services are subject to the deductible unless otherwise stated.

Get a Quote

View More Carriers

The CaliforniaChoice employee benefits program lets your employees select health plans (HMO, PPO, HSA, and more) from nine of California's top carriers while you determine how much your

company will contribute.Click on any of the logos below to learn more about our carrier partners

Jump to:

Anthem MediBlue Access Core (PPO) H4036-016 is a 2021 Medicare Advantage Plan or Medicare Part-C plan by Anthem Blue Cross and Blue Shield available to residents in Wisconsin. This plan does not provide additional Medicare prescription drug (Part-D) coverage. The Anthem MediBlue Access Core (PPO) has a monthly premium of $0 and has an in-network Maximum Out-of-Pocket limit of $5,500 (MOOP). This means that if you get sick or need a high cost procedure the co-pays are capped once you pay $5,500 out of pocket. This can be a extremely nice safety net.

Anthem MediBlue Access Core (PPO) is a Local PPO *. A preferred provider organization (PPO) is a Medicare plan that has created contracts with a network of 'preferred' providers for you to choose from at reduced rates. You do not need to select a primary care physician and you do not need referrals to see other providers in the network. Offering you a little more flexibility overall. You can get medical attention from a provider outside of the network but you will have to pay the difference between the out-of-network bill and the PPOs discounted rate.

Anthem Blue Cross and Blue Shield works with Medicare to provide significant coverage beyond Part A and Part B benefits. If you decide to sign up for Anthem MediBlue Access Core (PPO) you still retain Original Medicare. But you will get additional Part A (Hospital Insurance) and Part B (Medical Insurance) coverage from Anthem Blue Cross and Blue Shield and not Original Medicare. With Medicare Advantage Plans you are always covered for urgently needed and emergency care. Plus you receive all of the benefits of Original Medicare from Anthem Blue Cross and Blue Shield except hospice care. Original Medicare still provides you with hospice care even if you sign up for a Medicare Advantage Plan.

Ready to Enroll?

Or Call

1-855-778-4180

Mon-Fri 8am-9pm EST

Sat 9am-9pm EST2021 Anthem Blue Cross and Blue Shield Medicare Advantage Plan Costs

Name: Plan ID: H4036-016Provider: Anthem Blue Cross and Blue Shield Year: 2021 Type: Local PPO * Monthly Premium C+D: $0 Part C Premium: MOOP: $5,500 Similar Plan: H4036-017 2021 Anthem MediBlue Access Core (PPO) Summary of Benefits

Additional Benefits

What Does Anthem Blue Cross Ppo Cover

No Comprehensive Dental

Diagnostic services $0 copay Diagnostic services $0 copay (Out-of-Network) Endodontics $0 copay Endodontics $0 copay (Out-of-Network) Extractions $0 copay Extractions $0 copay (Out-of-Network) Non-routine services $0 copay Non-routine services $0 copay (Out-of-Network) Periodontics $0 copay Periodontics $0 copay (Out-of-Network) Prosthodontics, other oral/maxillofacial surgery, other services $0 copay Prosthodontics, other oral/maxillofacial surgery, other services $0 copay (Out-of-Network) Restorative services $0 copay Restorative services $0 copay (Out-of-Network) Deductible

$500 annual deductible Diagnostic Tests and Procedures

Diagnostic radiology services (e.g., MRI) $130-215 copay Diagnostic radiology services (e.g., MRI) 35% coinsurance (Out-of-Network) Diagnostic tests and procedures $0-150 copay Diagnostic tests and procedures 35% coinsurance (Out-of-Network) Lab services $0-10 copay Lab services 35% coinsurance (Out-of-Network) Outpatient x-rays $50-110 copay Outpatient x-rays 35% coinsurance (Out-of-Network) Doctor Visits

Primary $40 copay per visit (Out-of-Network) Primary $5 copay per visit Specialist $40 copay per visit Specialist $60 copay per visit (Out-of-Network) Emergency care/Urgent Care

Emergency $90 copay per visit (always covered) Urgent care $35 copay per visit (always covered) Foot Care (podiatry services)

Foot exams and treatment $0-40 copay Foot exams and treatment $60 copay (Out-of-Network) Routine foot care $0 copay Routine foot care $60 copay (Out-of-Network)

Ground Ambulance

What Is The Copay For Anthem Blue Cross

$265 copay $265 copay (Out-of-Network) Hearing

Fitting/evaluation $0 copay Fitting/evaluation 20% coinsurance (Out-of-Network) Hearing aids $0 copay Hearing aids 50% coinsurance (Out-of-Network) Hearing exam $40 copay Hearing exam $60 copay (Out-of-Network) Inpatient Hospital Coverage

$295 per day for days 1 through 7

$0 per day for days 8 through 9050% per stay (Out-of-Network) Medical Equipment/Supplies

Diabetes supplies $0 copay Diabetes supplies 40% coinsurance per item (Out-of-Network) Durable medical equipment (e.g., wheelchairs, oxygen) 0-20% coinsurance per item Durable medical equipment (e.g., wheelchairs, oxygen) 40% coinsurance per item (Out-of-Network) Prosthetics (e.g., braces, artificial limbs) 20% coinsurance per item Prosthetics (e.g., braces, artificial limbs) 40% coinsurance per item (Out-of-Network) Medicare Part B Drugs

Chemotherapy 20% coinsurance Chemotherapy 40% coinsurance (Out-of-Network) Other Part B drugs 20% coinsurance Other Part B drugs 40% coinsurance (Out-of-Network) Mental Health Services

Inpatient hospital - psychiatric $250 per day for days 1 through 7

$0 per day for days 8 through 90Inpatient hospital - psychiatric 50% per stay (Out-of-Network) Outpatient group therapy visit $40 copay Outpatient group therapy visit $60 copay (Out-of-Network) Outpatient group therapy visit with a psychiatrist $40 copay Outpatient group therapy visit with a psychiatrist $60 copay (Out-of-Network) Outpatient individual therapy visit $40 copay Outpatient individual therapy visit $60 copay (Out-of-Network) Outpatient individual therapy visit with a psychiatrist $40 copay Outpatient individual therapy visit with a psychiatrist $60 copay (Out-of-Network) Anthem Blue Cross Ppo Contact

MOOP

$10,000 In and Out-of-network

$5,500 In-networkOption

No Optional supplemental benefits

Yes Outpatient Hospital Coverage

$0 copay or 20% coinsurance per visit 50% coinsurance per visit (Out-of-Network) Package #1

Deductible Monthly Premium $16.00 Package #2

Deductible Monthly Premium $28.00 Package #3

Deductible Monthly Premium $50.00

Preventive Care

$0 copay 40% coinsurance (Out-of-Network) Preventive Dental

Cleaning $0 copay Cleaning 20% coinsurance (Out-of-Network) Dental x-ray(s) $0 copay Dental x-ray(s) 20% coinsurance (Out-of-Network) Fluoride treatment $0 copay Fluoride treatment 20% coinsurance (Out-of-Network) Oral exam $0 copay Oral exam 20% coinsurance (Out-of-Network) Rehabilitation Services

Occupational therapy visit $35 copay Occupational therapy visit $60 copay (Out-of-Network) Physical therapy and speech and language therapy visit $35 copay Physical therapy and speech and language therapy visit $60 copay (Out-of-Network) Skilled Nursing Facility

$0 per day for days 1 through 20

$184 per day for days 21 through 10050% per stay (Out-of-Network) Transportation

Not covered Vision

Blue Cross Blue Shield Ppo Copay

Contact lenses $0 copay Contact lenses $0 copay (Out-of-Network) Eyeglass frames $0 copay Eyeglass frames $0 copay (Out-of-Network) Eyeglass lenses $0 copay Eyeglass lenses $0 copay (Out-of-Network) Eyeglasses (frames and lenses) $0 copay Eyeglasses (frames and lenses) $0 copay (Out-of-Network) Other Not covered Routine eye exam $0 copay Routine eye exam $0 copay (Out-of-Network) Upgrades Not covered Wellness Programs (e.g. fitness nursing hotline)

Covered Reviews for Anthem MediBlue Access Core (PPO) H4036

2019 Overall Rating Part C Summary Rating Part D Summary Rating Staying Healthy: Screenings, Tests, Vaccines Managing Chronic (Long Term) Conditions Member Experience with Health Plan Complaints and Changes in Plans Performance Health Plan Customer Service Drug Plan Customer Service Complaints and Changes in the Drug Plan Member Experience with the Drug Plan Drug Safety and Accuracy of Drug Pricing Staying Healthy, Screening, Testing, & Vaccines

Total Preventative Rating Breast Cancer Screening Colorectal Cancer Screening Annual Flu Vaccine Improving Physical Improving Mental Health Monitoring Physical Activity Adult BMI Assessment Managing Chronic And Long Term Care for Older Adults

Total Rating SNP Care Management Medication Review Functional Status Assessment Pain Screening Osteoporosis Management Diabetes Care - Eye Exam Diabetes Care - Kidney Disease Diabetes Care - Blood Sugar Rheumatoid Arthritis Reducing Risk of Falling Improving Bladder Control Medication Reconciliation Statin Therapy Member Experience with Health Plan

Total Experience Rating Getting Needed Care Customer Service Health Care Quality Rating of Health Plan Care Coordination Anthem Blue Cross Ppo Specialist Copay

Member Complaints and Changes in Anthem MediBlue Access Core (PPO) Plans Performance

Total Rating Complaints about Health Plan Members Leaving the Plan Health Plan Quality Improvement Timely Decisions About Appeals Health Plan Customer Service Rating for Anthem MediBlue Access Core (PPO)

Total Customer Service Rating Reviewing Appeals Decisions Call Center, TTY, Foreign Language Anthem MediBlue Access Core (PPO) Drug Plan Customer Service Ratings

Total Rating Call Center, TTY, Foreign Language Appeals Auto Appeals Upheld Ratings For Member Complaints and Changes in the Drug Plans Performance

Total Rating Complaints about the Drug Plan Members Choosing to Leave the Plan Drug Plan Quality Improvement Member Experience with the Drug Plan

Total Rating Rating of Drug Plan Getting Needed Prescription Drugs Drug Safety and Accuracy of Drug Pricing

Total Rating MPF Price Accuracy Drug Adherence for Diabetes Medications Drug Adherence for Hypertension (RAS antagonists) Drug Adherence for Cholesterol (Statins) MTM Program Completion Rate for CMR Statin with Diabetes Anthem Blue Cross Ppo Contact Number

Ready to Enroll?

Or Call

1-855-778-4180

Mon-Sat 8am-11pm EST

Sun 9am-6pm ESTCoverage Area for Anthem MediBlue Access Core (PPO)

(Click county to compare all available Advantage plans)

State: Wisconsin County: Adams,Ashland,Bayfield,Brown,Calumet,

Clark,Dodge,Door,Douglas,

Florence,Fond du Lac,Forest,Green,

Green Lake,Iowa,Iron,Jefferson,

Juneau,Kenosha,Kewaunee,Lafayette,

Langlade,Lincoln,Manitowoc,Marathon,

Marinette,Marquette,Menominee,Milwaukee,

Oconto,Oneida,Outagamie,Ozaukee,

Portage,Price,Racine,Rock,

Shawano,Sheboygan,Taylor,Vilas,

Walworth,Washington,Waukesha,Waupaca,

Waushara,Winnebago,

Go to topSource: CMS.

Data as of September 9, 2020.

Notes: Data are subject to change as contracts are finalized. For 2021, enhanced alternative may offer additional cost sharing reductions in the gap on a sub-set of the formulary drugs, beyond the standard Part D benefit.Includes 2021 approved contracts. Employer sponsored 800 series and plans under sanction are excluded.